Vehicle manufacturer attempting to make up for lost time to Tesla Inc’s. TSLA – 2.17%decrease; red down pointing triangle electric vehicles were tossed a curve as of late with Elon Musk’s most recent objective: slicing the expense of working cutting edge vehicles by half before long.

Experts as of now gauge Tesla’s top of the line vehicles appreciate the huge number of dollars in cost benefits over rivals in delivering EVs, and those competitors have been attempting to close the hole.

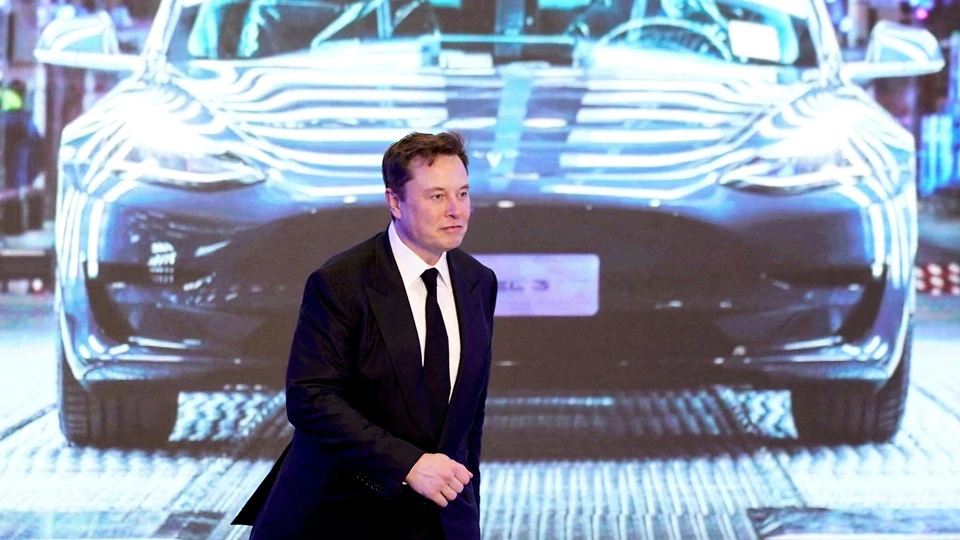

“There is a clear path to making smaller vehicle that is roughly half the production cost and difficulty of our Model 3,” Mr. Musk said earlier this month during a Morgan Stanley conference.

His comments reiterated a target highlighted during the auto maker’s investor day. A Tesla executives goal to achieve the cost reductions through a combination of vertical integration, factory automation, part reductions and next steps.

Mr. Musk, who has a background marked by missing aggressive valuing objectives, hasn’t nitty gritty explicit figures, or when the vehicles will make a big appearance. In any case, those reserve funds are seen by examiners as permitting Tesla to offer a long-guaranteed $25,000 electric vehicle without obliterating the organization’s business driving, twofold digit-rate edges.

Tesla didn’t answer a solicitation for input.

Since the earliest days of the car business, leaders have been fixated on reducing expenses, an undertaking that has filled the improvement of the sequential construction system, chaotic consolidations, worldwide collusions, and plan and designing redesigns — all pointed toward tracking down ways of saving dollars, in the event that not pennies, on every vehicle

Be that as it may, their endeavors have taken on new earnestness as auto leaders are pressed facing a twin conflict of exploring inflationary expense increments, while likewise putting vigorously in electric vehicles as financial backers and controllers give need to this innovation.

“This kind of ratchets up the tension” on conventional car creators, said Imprint Wakefield, an overseeing chief for counseling firm AlixPartners LLP, which gauges that the car business has committed a joined $526 billion to switch setups over completely to electric vehicles through 2026.

That financing is happening in front of most organizations seeing some genuine advantages from economies of scale from EV deals, which have been developing firmly yet represent a little piece of by and large worldwide conveyances.

The new strain brought by Mr. Musk was apparent Tuesday when Volkswagen AG Commitment – 0.88%decrease; red down pointing triangle met with examiners and financial backers.

UBS examiner Patrick Hummel alluded to Tesla’s expense cutting plans in getting some information about its EV named the ID. 3, which he expressed begins at about $40,000 in Europe and is “somewhat above earn back the original investment levels” for the organization.

“I truly battle to find out how VW is turning out to have a reasonable EV that is productive to you in several years’ time,” he told the chiefs.

“We are extremely mindful that opposition will become harder,” Arno Antlitz, VW’s CFO, said. “So we attempt to remain as fixed as conceivable on the above cost side.”

Eventually, Volkswagen is wagering its freshest age of EVs, worked with normal parts, will give it scale after some time to diminish costs. Furthermore, Mr. Antlitz emphasized that the organization designs an EV estimated underneath €25,000, or around $27,000. The organization showed an idea variant of the impending model last week and said it would show up in 2025 in Europe.

Tesla Semi And CyberTruck Go Head-To-Head

“We will have a critical scale by then, at that point,” he said.

Tesla’s development to standard car manufacturer accompanied the Model 3 sedan, what begins at around $45,000 in the U.S., and should be a $35,000 vehicle when it was uncovered in 2016. Yet, it wasn’t presented at that cost when production started in 2017 as the organization couldn’t deliver it without losing cash, Mr. Musk has said.

All things considered, Tesla has taken part in persistent endeavors to shave away expense, saying it has accomplished 30%, upgrades beginning around 2018 through an entire host of regions, including efficiency, designing changes and provider scale. Chiefs say these activities portend how they will accomplish more decreases for the cutting edge vehicles.

Caresoft Worldwide, which destroys vehicles to look at costs between contenders, gauges Tesla’s Model Y reduced sport-utility vehicles have basically a $3,000 cost benefit to contenders’ tantamount contributions, barring batteries, said the counseling company’s CEO, Mathew Vachaparampil.

Regardless of whether Mr. Musk is ineffective at arriving at 50% decrease, industry spectators say any huge exertion toward that objective would be significant. Essentially, Mr. Musk’s cases set another bar with financial backers in which to pass judgment on vehicle organizations’ capacity to rival Tesla.

“This is them trying the business,” said Mark Fields, a previous Chief of Passage F – 4.40%decrease; red down pointing triangle Engine Co. “Is the remainder of the business going to stand up and take note? I figure they will.”

Investors have previously had serious misgivings of customary car producers’ capacity to rival Tesla.

At a meeting in February, Rod Lache, an expert in Wolfe Research, told Ford President Jim Farley that in his company’s study of 100 investors, 92% said they didn’t figure conventional vehicle producers could match Tesla on cost.

Mr. Farley wasn’t amazed. He frequently refers to Tesla’s more than $10,000-per-vehicle cost advantage while discussing the need to make changes. To break inward opposition, he has done whatever it takes to put the organization into new gatherings — remembering one working for future EVs — with an end goal to empower new reasoning.

Ford’s EV exertion is benchmarking against Tesla’s edges, Lisa Drake, Passage’s VP of EV industrialization, has said. Last year, she said the organization will arrive at the sorts of volumes of EV deals in 2026 that give them scale.

“That will assist us with opening a portion of that cost productivity that we want,” she said.

Additionally, Mr. Lache asked General Motors Co. Chief Mary Barra about matching Tesla’s expense construction and edges.

“Our point is to have industry-driving edges as we contribute,” Ms. Barra said.

In the wake of going to the organization’s investor day, Morgan Stanley analyst Adam Jonas, a long-lasting Tesla bull, left away persuaded customary vehicle producers will confront a difficult time matching in EV benefit.